Andrews Pitchfork Mt4 Platform

Classic Technical ToolAmong the core range of technical tools and indicators available on most MT4 platforms, the Andrews Pitchfork remains a firm favourite. Long used by technical analysts as a precise way of measuring trend and capturing turning points, the tool is celebrated for both its simplicity and effectiveness.The tool consists of three lines which are drawn by selecting three points on the charts which are typically reaction highs or lows.

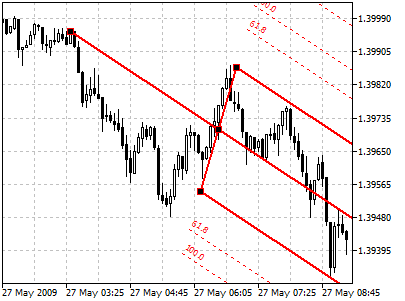

As with regular trend lines and channels, the lines of the Andrew’s Pitchfork denote areas of support and resistance as well as providing a visual aid for trend direction. So long as price remains inside the pitchfork, the trend remains intact. Once price breaks out of the pitchfork, a reversal is likely underway. Bearish PitchforkWhen applying a bearish pitchfork, traders need to consider the following three points. Initial high. Reaction low. Secondary highOnce these points are selected, the tool will then apply the lines of the pitchfork.

You will note there is an upper resistance trend line, a lower supporting trendline and also a median line which bisects price action and is equidistant to the upper and lower lines. As the tool is a discretionary tool you might find that you need to adjust the lines so that they properly account for price action and give a realistic and relevant slope, as sometimes the tool might initially plot lines that are too steep. Bullish PitchforkWhen applying a bullish pitchfork, traders need to find the following three points.

Download Mt4 Platform For Pc

Jan 22, 2015. Andrews' Pitchfork was developed by the renown educator Dr. Andrews using the median line concept that was established by Roger Babson. On September 5, 1929, Mr. Babson famously gave a speech where he proclaimed “ a crash is coming, and it will be terrific” and, of course, Black. Andrews Pitchfork Trading Strategy Conclusion. There are many Andrews Pitchfork trading strategies that can be built around the Pitchfork trading system lines and they can all be simply derived from the Pitchfork’s trading rules. In order to be able to use this system you need to understand what is Andrews Pitchfork. Each trend line starts from a pivot point, and Andrews called them P0, P1, and P2. When you apply the Andrews Pitchfork mt4 indicator on a chart, the platform asks you to make three clicks. The first click represents, P0, the second one P1 and the last one P2. They show the Andrews Pitchfork starting point.

The initial low. The reaction high. The secondary lowOnce these points are selected, the tool will then apply the lines of the pitchfork. You will note there is an upper resistance trend line, a lower supporting trendline and also a median line which bisects price action and is equidistant to the upper and lower lines. As the tool is a discretionary tool you might find that you need to adjust the lines so that they properly account for price action and give a realistic and relevant slope, as sometimes the tool might initially plot lines that are too steep.Once the trend lines are in place trader can use them as they would regular trend lines, and channels looking to buy trend line support and sell trend line resistance. In a bullish trend, the median line can also be used to provide support, and in a bearish trend, the median line can also be used to provide resistance.As with regular trend lines and channels, it is important to update your trend lines as price action unfolds.

Once a pitchfork is broken, and traders anticipate a reversal is underway traders can then look to trade a retest of the broken pitchfork. Where price breaks out above a bearish pitchfork, traders can look for price to trade back down and find support at the broken pitchfork which can be used for a long entry.Similarly, where price breaks down below a bullish Pitchfork, traders can look for price to trade back up and find resistance at the broken pitchfork which can be used as a short entry.In the example, above you can see that we have a clear bullish Pitchfork in play, having identified our three selection points. After testing the lower supporting trendline of the pitchfork twice, price eventually breaks down below the pitchfork indicating a likely bearish reversal. Note how price then trades back up to retest the broken lower trend line of the pitchfork where price finds resistance and ultimately sells off. This dynamic often plays out with broken pitchforks and can be a fantastic way for traders to capitalize on a shift in market direction.As with all tools and indicators, they can only form part of your trading system and traders should spend the necessary time developing sound risk management practices to help develop a positive returns strategy. The Andrew’s Pitchfork can be a fantastic tool for helping traders frame trend direction and identify potential trade locations and can either be used alone or in conjunction with other technical indicators and tools. With over 6 years’ experience analysing currency markets, James is now a well-known industry analyst focusing on price action trading and fundamental drivers.

Beginning as a private retail trader, James developed a strong interest in understanding the fundamental aspect of the market before pursuing technical trading capabilities which he now uses to identify opportunities over a short-term horizon. Alongside his market experience, James is also IMC certified having achieved the qualification to help further his understanding not only of the markets but the industry as a whole.James has a strong interest in both fundamentals and technicals and uses both forms of analysis in generating and executing trade ideas, with trades generally lasting from a few hours to a few days. License: Orbex LIMITED (HE 258884) is a fully licensed and Regulated Cyprus InvestmentFirm (CIF)governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (LicenseNumber124/10). Orbex LIMITED is licensed to provide Investment Services (Reception &Transmission,Execution and Dealing on own account) and Ancillary Services.Risk Warning: Trading foreign exchange on margin carries a high level of risk, and maynot besuitable for all investors.

Before deciding to trade foreign exchange, you should carefullyconsideryour investment objectives, level of experience, and risk appetite. There is a possibilitythat you maysustain a loss of some or all of your investment and therefore you should not invest moneythat youcannot afford to lose. You should be aware of all the risks associated with foreign exchangetrading,and seek advice from an independent financial advisor if you have any doubts.